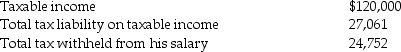

Frederick failed to file his 2012 tax return on a timely basis.In fact,he filed his 2012 income tax return on October 31,2013,(the due date was April 15,2013)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2012 return:

Frederick sent a check for $2,309 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2012.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $2,309 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2012.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Value of Money

The value of money is the purchasing power of currency, which determines the amount of goods or services that can be purchased with a unit of currency.

Dollar Prices

The price of a good or service expressed in units of the U.S. dollar.

Relative Prices

The price of one good or service compared to another, typically influencing consumer choice and resource allocation.

Nominal Variables

Variables measured in monetary terms and not adjusted for inflation, representing prices or values at the time of transaction.

Q13: Companies will not suffer negative consequences if

Q23: Latashia reports $100,000 of gross income on

Q28: Discounted-cash-flow models are not based on the

Q51: Which one of the following items is

Q66: While certain income of a minor is

Q68: An asset of $180,000 is expected to

Q79: In capital budgeting decisions,the riskiness of a

Q83: Decentralization is the delegation of freedom to

Q84: The standard deduction is the maximum amount

Q107: A key factor in determining tax treatment