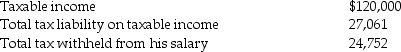

Frederick failed to file his 2012 tax return on a timely basis.In fact,he filed his 2012 income tax return on October 31,2013,(the due date was April 15,2013)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2012 return:

Frederick sent a check for $2,309 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2012.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $2,309 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2012.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

List Box

A user interface element that displays a list of options from which a user can select one or more items.

Text Box

A GUI element that enables the user to input text information into a document, form, or web page.

Text Box Controls

UI elements within a software application that allow users to input text into a designated area.

Record Source

The origin or database from which records are retrieved or stored, often specified in database management systems or reporting tools.

Q12: Mark purchased 2,000 shares of Darcy Corporation

Q23: Rick chose the following fringe benefits under

Q40: Which of the following credits is considered

Q45: The proponents of gross book value maintain

Q56: Natasha,age 58,purchases an annuity for $40,000.Natasha will

Q90: Under the accrual method of accounting,income is

Q98: What statement about management accounting is FALSE?<br>A)Management

Q126: For a cash basis taxpayer,security deposits received

Q127: Discuss the role management accountants play in

Q127: Billy,age 10,found an old baseball glove while