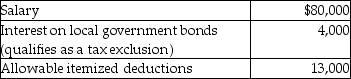

A single taxpayer provided the following information for 2013:  What is taxable income?

What is taxable income?

Definitions:

Investment

Investment refers to the allocation of resources, such as capital, time, or assets, with the expectation of generating profit or income, involving mechanisms like stocks, bonds, real estate, or other financial vehicles.

Present Value Factors

Multipliers used to calculate the present value of a future sum of money or stream of cash flows given a specific interest rate.

Compound Interest

Interest computed on the original amount of a deposit or loan, incorporating all previously accrued interest from past periods.

Desired Rate

Typically refers to the target interest rate set by individuals or businesses for financial returns or lending activities.

Q9: Forever Company has a tax rate of

Q29: Adam Smith's canons of taxation are equity,certainty,convenience

Q48: AAA Corporation distributes an automobile to Alexandria,a

Q62: Gifts between spouses are generally exempt from

Q83: Which of the following taxes is regressive?<br>A)Federal

Q84: The following information is available for the

Q86: Adam attended college for much of 2013,during

Q90: Business investigation expenses incurred by a taxpayer

Q97: Carla redeemed EE bonds which qualify for

Q136: The use of accelerated depreciation for tax