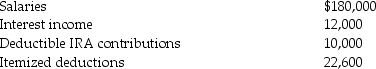

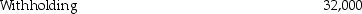

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2013.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

Definitions:

Diplomatic

Pertaining to the conduct by government officials of negotiations and other relations between nations or handling affairs without arousing hostilities.

Timmons Model

A framework for understanding and planning new business ventures that balances opportunity, resources, and team.

Market Demand

The total quantity of a product or service that consumers are willing and able to purchase at various price levels.

Demographic Profile

A statistical analysis of the characteristics of a specific population, including age, race, gender, income, and education.

Q5: If a 13-year-old has earned income of

Q14: Discuss the requirements for meals provided by

Q47: What do Certified Management Accountants and Certified

Q71: A check received after banking hours is

Q78: The management accountant prepares the following performance

Q79: During the current year,Don's aunt Natalie gave

Q87: An unmarried taxpayer may file as head

Q90: The marginal tax rate is useful in

Q94: Normally,a security dealer reports ordinary income on

Q124: Nate and Nikki have three dependent children