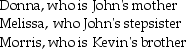

John supports Kevin,his cousin,who lived with him throughout 2013.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $3,900.How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $3,900.How many personal and dependency exemptions may John claim?

Definitions:

Liberal Congressmen

Liberal Congressmen are members of the United States Congress who advocate for liberal policies, including social equality, environmental protection, and economic regulation for public welfare.

Voting Rights Act

The Voting Rights Act of 1965 is landmark federal legislation in the United States aimed at overcoming legal barriers at the state and local levels that prevented African Americans from exercising their right to vote under the 15th Amendment.

Tenth Amendment

The Tenth Amendment to the United States Constitution, part of the Bill of Rights, expresses the principle that the federal government possesses only those powers delegated to it by the states or the people.

Freedom Summer

A 1964 voter registration drive aimed at increasing the number of registered black voters in Mississippi, highlighted by grassroots community organizing and widespread civil rights activism.

Q8: Daniel purchased qualified small business corporation stock

Q49: All of the following items are deductions

Q57: An accrual-basis taxpayer may elect to accrue

Q88: Max sold the following capital assets in

Q90: The following information pertains to Saturn Company:

Q92: A firm is a good candidate for

Q98: What statement about management accounting is FALSE?<br>A)Management

Q99: A deduction will be allowed for an

Q104: If the segments in a firm buy

Q129: Edward,a single taxpayer,has AGI of $50,000 which