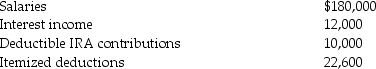

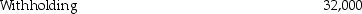

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2013.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

Definitions:

Phase Angle

The difference in phase between the inputs and outputs of a system, often measured in degrees or radians.

Parallel Circuit

An electrical circuit in which components are connected so that the same voltage is applied to each component, but the total current is divided among the components.

Inductive Reactance

The opposition that an inductor presents to alternating current, due to its inductance, proportional to the frequency of the current.

Confederation Congress

The governing body of the United States under the Articles of Confederation, serving from 1781 to 1789, before the adoption of the Constitution.

Q14: Discuss the requirements for meals provided by

Q34: According to agency theory,employment contracts will balance

Q36: Alexis and Terry have been married five

Q39: The regular standard deduction is available to

Q71: A check received after banking hours is

Q72: The cash receipts and disbursements method of

Q85: Bret carries a $200,000 insurance policy on

Q119: Organizations should choose performance metrics that improve

Q121: The transfer price is revenue to the

Q145: Identify the disadvantages of decentralization.