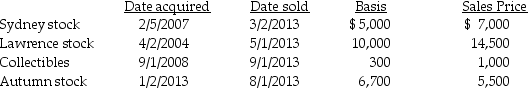

Chen had the following capital asset transactions during 2013:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Definitions:

Insurance Expense

The cost incurred by a company to maintain insurance coverage on its assets, operations, or liabilities, recognized periodically as an operating expense.

Factory Building

Real estate property that is used for manufacturing operations, including the production of goods and materials.

Work in Process

Inventory that is in the production process and is not yet finished. It includes the cost of raw materials, labor, and overhead used in the production process.

Factory Overhead

Costs associated with the manufacturing process that are not directly tied to the product being manufactured, such as utilities, maintenance, and managerial salaries.

Q3: Chelsea,who is self-employed,drove her automobile a total

Q21: Steve Greene is divorced,age 66,has good eyesight,and

Q29: David gave property with a basis of

Q43: Juanita's mother lives with her.Juanita purchased clothing

Q53: Ruby Corporation grants stock options to Iris

Q67: Deductions for adjusted gross income include all

Q76: Natasha is a single taxpayer with a

Q95: Taxpayers who own mutual funds recognize their

Q111: Self-employed individuals may claim,as a deduction for

Q126: For a cash basis taxpayer,security deposits received