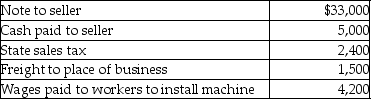

Dennis purchased a machine for use in his business.Mr.Dennis' costs in connection with this purchase were as follows:  What is the amount of Mr.Dennis' basis in the machine?

What is the amount of Mr.Dennis' basis in the machine?

Definitions:

Extreme Achievement

Accomplishments that go far beyond the usual or expected levels of success.

Perfectionism

The refusal to accept any standard short of perfection, often leading to high stress and anxiety.

Machiavellianism

A personality trait characterized by manipulation, deceit, and exploitation of others for personal gain.

Emotionally Detached

A state where an individual is not emotionally involved or influenced by emotions in a particular situation or towards others.

Q12: DeMarcus and Brianna are married and live

Q13: A flood damaged an auto owned by

Q30: The Cable TV Company,an accrual basis taxpayer,allows

Q43: All of the following statements are true

Q51: When are points paid on a loan

Q52: Amounts collected under accident and health insurance

Q76: Brett,a single taxpayer with no dependents,earns salary

Q96: Pamela was an officer in Green Restaurant

Q113: If an activity produces a profit for

Q117: What are arguments for and against preferential