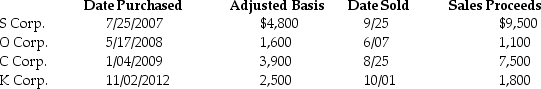

Mike sold the following shares of stock in 2013:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Definitions:

Outgroup Members

Individuals who are perceived as not belonging to one's own group, often leading to distinction and bias against them.

Accentuation Effect

Overestimation of similarities among people within a category and dissimilarities between people from different categories.

Overestimation

The cognitive bias of assessing a quantity or quality as being larger, greater, or more important than it actually is.

Category

A general concept that classifies items, concepts, or ideas that share common characteristics.

Q3: Jan has been assigned to the Rome

Q4: Rachel has significant travel and entertainment expenses

Q5: Travel expenses for a taxpayer's spouse are

Q15: Taxpayers may deduct legal fees incurred in

Q30: Unreimbursed employee business expenses are deductions from

Q52: Gayle,a doctor with significant investments in the

Q66: During the current year,Paul,a single taxpayer,reported the

Q72: Joy purchased 200 shares of HiLo Mutual

Q83: On August 1 of this year,Sharon,a cash

Q132: Generally,itemized deductions are personal expenses specifically allowed