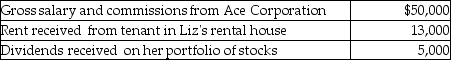

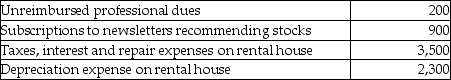

Liz,who is single,lives in a single family home and owns a second single family home that she rented for the entire year at a fair rental rate.Liz had the following items of income and expense during the current year. Income: Expenses:

Expenses: What is her adjusted gross income for the year?

What is her adjusted gross income for the year?

Definitions:

Employee Wages

Compensation paid to employees for their labor or services, typically calculated on an hourly, daily, or piecework basis.

Cash Flow from Operating Activities

A measure of the cash generated by a company's normal business operations.

Cash Paid

Money that a company spends during a period for operating activities, investments, and financing activities, excluding non-cash transactions.

Dividends to Stockholders

Payments made to shareholders out of a corporation's profits as a reward for investing in its shares.

Q35: Gains and losses are recognized when property

Q36: Elaine owns an unincorporated manufacturing business.In 2013,she

Q38: Candice owns a mutual fund that reinvests

Q46: Under a qualified pension plan,the employer's deduction

Q63: Jason,who lives in New Jersey,owns several apartment

Q73: The MACRS system requires that residential real

Q77: Qualified residence interest consists of both acquisition

Q97: Explain when educational expenses are deductible for

Q108: Bob owns 100 shares of ACT Corporation

Q109: Mirasol Corporation granted an incentive stock option