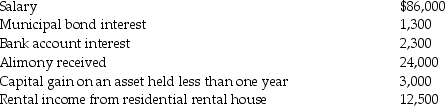

During the current year,Donna,a single taxpayer,reports the following items income of income and expenses:

Income:

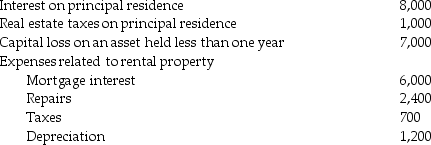

Expenses/losses:

Expenses/losses:

Compute Donna's taxable income.(Show all calculations in good form.)

Compute Donna's taxable income.(Show all calculations in good form.)

Definitions:

Buyer in the Ordinary Course

An individual who purchases goods in good faith from a seller who is in the normal course of business of selling such goods.

UCC

The Uniform Commercial Code, a comprehensive set of laws governing commercial transactions in the United States, designed to harmonize the law of sales and other commercial contracts.

Convention on Contracts for International Sale of Goods

An international treaty that establishes a uniform framework for the law governing the international sale of goods.

Contract Contains

The provision, clauses, and terms encapsulated within a legally binding agreement.

Q2: Commuting to and from a job location

Q11: A cash-basis taxpayer can defer income recognition

Q19: Connor owes $4 million and has assets

Q25: Corporations issuing incentive stock options receive a

Q48: In 2006,Regina purchased a home in Las

Q51: When are points paid on a loan

Q69: Except in a few specific circumstances,once adopted,an

Q71: A check received after banking hours is

Q82: To be tax deductible,an expense must be

Q92: Payments from an annuity purchased from an