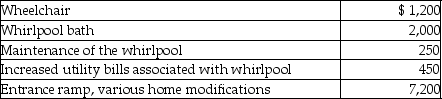

Alan,who is a security officer,is shot while on the job.As a result,Alan suffers from a chronic leg injury and must use a wheelchair and undergo therapy to regain and retain strength.Alan's physician recommends that he install a whirlpool bath in his home for therapy.During the year,Alan makes the following expenditures:  A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

Definitions:

Organizational Control

The procedures and mechanisms used by a business to regulate its actions and align its behaviors with its objectives.

Ridicule

The act of making someone or something the object of scornful laughter by mocking or deriding them.

Executive Reality Check

A method or process where business leaders review and assess the current state and health of their organization, ensuring perceptions align with actual performance and strategies.

Organizational Control

Mechanisms and processes put in place within an organization to guide, manage, and evaluate its resources and actions towards achieving set objectives.

Q31: Ross works for Houston Corporation,which has a

Q32: Amounts withdrawn from Qualified Tuition Plans are

Q42: During 2013,Christiana's employer withheld $1,500 from her

Q43: All of the following statements are true

Q55: During the current year,Tony purchased new car

Q57: An accrual-basis taxpayer may elect to accrue

Q77: Ahmad's employer pays $10,000 in tuition this

Q91: Any Section 179 deduction that is not

Q91: Punitive damages are taxable unless they are

Q111: Self-employed individuals may claim,as a deduction for