MrAnd MrsThibodeaux,who Are Filing a Joint Return,have Adjusted Gross Income of of $75,000.During

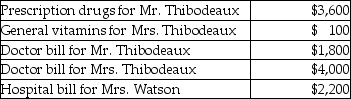

Mr.and Mrs.Thibodeaux,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Break-even Point

The production level or sales volume at which total revenues equal total expenses, resulting in no net profit or loss.

Break-even Point

The level of production or sales at which the revenues of a business equal its costs, resulting in neither profit nor loss.

Total Contribution Margin

This refers to the total amount of revenue left over after deducting all variable costs, indicating the total contribution towards covering fixed costs and generating profit.

Break-even Point

The point at which total revenue equals total costs, resulting in no profit or loss for the business.

Q27: Doug pays a county personal property tax

Q27: Speak Corporation,a calendar year accrual basis taxpayer,sells

Q28: Discuss the timing of the allowable medical

Q32: MACRS depreciation on an SUV weighing over

Q37: If a new luxury automobile is used

Q40: The installment method may be used for

Q56: Under the MACRS system,depreciation rates for real

Q81: Losses on the sale of property between

Q82: Awards for emotional distress attributable to a

Q84: Generally,Section 267 requires that the deduction of