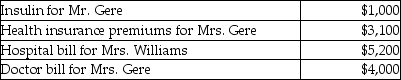

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Construct System

A psychological framework comprising an individual's core beliefs and values that guides perceptions and interpretations of the world.

Past Reinforcements

The influence of previously experienced rewards or punishments on present behavior, a concept frequently discussed in behaviorism and conditioning theories.

Dichotomized Construct

A concept or variable that is divided into two mutually exclusive categories or groups.

Genetically Determined

Refers to traits or characteristics that are specified by an individual's DNA.

Q8: Sacha purchased land in 2010 for $35,000

Q15: Teri pays the following interest expenses during

Q32: Mitzi's medical expenses include the following: <img

Q43: All of the following items are excluded

Q61: In November 2013,Kendall purchases a computer for

Q64: Explain why interest expense on investments is

Q71: Explain how tax planning may allow a

Q72: Medical expenses incurred on behalf of children

Q74: Kathleen received land as a gift from

Q79: On its tax return,a corporation will use