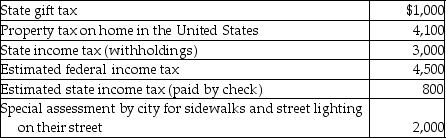

During the year Jason and Kristi,cash basis taxpayers,paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

Definitions:

Neurons

Specialized nerve system cells responsible for sending information to other neurons, muscles, or glands.

Pincer Grasp

The use of the opposing thumb to grasp objects between the thumb and other fingers.

Palmar Reflex

The palmar reflex is an involuntary response seen in infants, where the baby's fingers close around an object placed in their palm.

Ulnar Grasp

A developmental milestone in infants around 4 to 6 months of age, exhibiting a clumsy motion of reaching and grabbing objects using the whole hand, specifically utilizing the fingers and the ulnar side.

Q17: Taxpayers may not deduct interest expense on

Q18: When depreciating 5-year property,the final year of

Q29: An expense is considered necessary if it

Q36: Matt paid the following taxes: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5379/.jpg"

Q39: Thomas purchased an annuity for $20,000 that

Q50: Accelerated death benefits received by a terminally

Q67: CT Computer Corporation,an accrual basis taxpayer,sells service

Q97: Everest Inc.is a corporation in the 35%

Q103: Rita died on January 1,2013 owning an

Q124: In 2013,Richard,a single taxpayer,has adjusted gross income