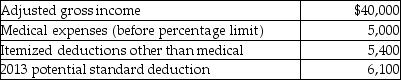

A review of the 2013 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2013 tax status:  In 2014,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

In 2014,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

Definitions:

SAT Score

A standardized test score used in the United States for college admissions, reflecting a testee's aptitude in areas such as math, reading, and writing.

College-Bound Seniors

High school students who have plans or have been accepted to attend a college or university for further education.

Social Inequality

Varied social positions or statuses within a society or group face unequal access to opportunities and rewards.

Parental Home Environment

The atmospheric and relational conditions within a child's home, including parenting styles and family dynamics, which influence development and behavior.

Q3: A taxpayer guarantees another person's obligation and

Q11: American Healthcare (AH),an insurance company,is trying to

Q19: Juan has a casualty loss of $32,500

Q35: Gina is an instructor at State University

Q39: Elisa sued her former employer for discrimination.She

Q41: Jorge owns activity X which produced a

Q78: West's adjusted gross income was $90,000.During the

Q100: Patrick and Belinda have a twelve year

Q103: On December 1,Robert,a cash method taxpayer,borrows $10,000

Q104: Sarah purchased a new car at the