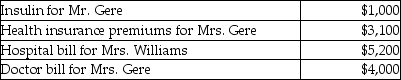

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Relevant Information

Information that is directly related and useful to the decision-making process.

Vroom-Jago Time-driven

A decision-making model that helps leaders determine how much participation they should allow from their team when making decisions, emphasizing the importance of time in decision-making processes.

Fiedler Contingency

A leadership theory positing that leader effectiveness depends on the situational context, specifically on how well the leader's style matches the situation.

Vroom-Jago Leadership

A decision-making model in leadership that assesses the level of team member participation that is most effective in different situations.

Q20: During the current year,the United States files

Q46: David has been diagnosed with cancer and

Q52: All of the following are capital assets

Q52: Julia owns 1,000 shares of Orange Corporation.This

Q64: Jackson Corporation granted an incentive stock option

Q65: Under the MACRS system,the same convention that

Q78: What are some factors which indicate that

Q83: Hope receives an $18,500 scholarship from State

Q98: Individuals are allowed to deduct the greater

Q112: If stock sold or exchanged is not