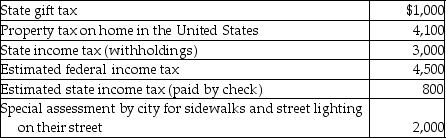

During the year Jason and Kristi,cash basis taxpayers,paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

Definitions:

Muscle Fiber

A single muscle cell, known for its long, cylindrical shape and role in contracting to produce movement.

Contractions

The action of muscle fibers shortening or tensing, which can produce movement or apply force, a fundamental process in muscle function.

Sarcoplasmic Reticulum

A specialized type of smooth endoplasmic reticulum found in muscle cells, involved in calcium storage and release for muscle contraction.

Active Transport

The movement of molecules across a cell membrane from a region of lower concentration to one of higher concentration, requiring energy.

Q18: When depreciating 5-year property,the final year of

Q19: Connor owes $4 million and has assets

Q36: The value of health,accident,and disability insurance premiums

Q38: Candice owns a mutual fund that reinvests

Q57: Jack purchases land which he plans on

Q57: Mattie has group term life insurance coverage

Q79: A taxpayer who uses the LIFO method

Q93: Generally,deductions for adjusted gross income on an

Q108: Bob owns 100 shares of ACT Corporation

Q129: Edward,a single taxpayer,has AGI of $50,000 which