Phoebe's AGI for the current year is $120,000.Included in this AGI is $100,000 salary and $20,000 of interest income.In earning the investment income,Phoebe paid investment interest expense of $30,000.She also incurred the following expenditures subject to the 2% of AGI limitation:

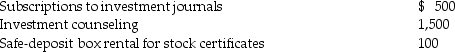

Investment expenses:

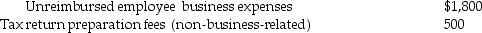

Noninvestment expenses:

Noninvestment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

Romantic Partner

A person with whom someone is involved in a romantic relationship.

Disapproval

An expression of dissatisfaction or disagreement with someone or something.

T-shirt Study

A series of experiments in social psychology that investigate how people perceive and judge others based on minimal information, such as their choice of clothing.

Selection Influence

The impact that the choice of individuals, groups, or elements to study can have on the outcome of research.

Q9: One of the requirements which must be

Q14: Discuss the requirements for meals provided by

Q42: When both borrowed and owned funds are

Q49: On May 1,2008,Empire Properties Corp.,a calendar year

Q57: The following taxes are deductible as itemized

Q69: Except in a few specific circumstances,once adopted,an

Q95: During the current year,Jack personally uses his

Q101: Harley,a single individual,provided you with the following

Q122: An employer-employee relationship exists where the employer

Q127: Billy,age 10,found an old baseball glove while