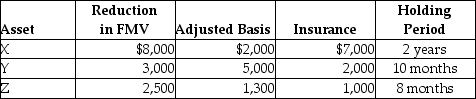

In the current year,Marcus reports the following casualty gains and losses on personal-use property.Assets X and Y are destroyed in the first casualty while Z is destroyed in a second casualty.  As a result of these losses and insurance recoveries,Marcus must report

As a result of these losses and insurance recoveries,Marcus must report

Definitions:

Guests

Individuals who receive services or hospitality, often in contexts such as hotels, restaurants, or events.

Billafuerte Jeep Tours

A hypothetical or specific company offering guided jeep tours in the Billafuerte region.

Cost Drivers

Factors that cause fluctuations in the cost of a product or service, such as machine-hours, labor-hours, or the quantity of materials used.

Planning Budget

A budget prepared for a future period that outlines an organization's financial goals, resources, and expenditures.

Q12: Interest is not imputed on a gift

Q13: Taxpayers are entitled to a depletion deduction

Q17: Stacy,who is married and sole shareholder of

Q21: Liza's employer purchased a disability income policy

Q33: Contributions to political candidates are not deductible

Q70: A taxpayer may use the FIFO or

Q92: In 2013 Anika Co.adopted the simplified dollar-value

Q92: Clayton contributes land to the American Red

Q103: Rita died on January 1,2013 owning an

Q110: During the current year,Lucy,who has a sole