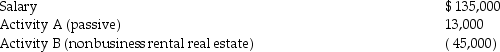

Parveen is married and files a joint return.He reports the following items of income and loss for the year:

If Parveen actively participates in the management of Activity B,what is his AGI for the year and what is the passive loss carryover to next year?

If Parveen actively participates in the management of Activity B,what is his AGI for the year and what is the passive loss carryover to next year?

Definitions:

Moral Breakdown

A situation where individuals or society fail to uphold ethical values, often leading to chaos or conflict.

Random Sample

A portion of a larger group collected in an unbiased way.

Inferences

The process of drawing logical conclusions from available evidence or premises.

Contraceptive Techniques

Strategies or instruments employed to avoid pregnancy after engaging in sexual relations.

Q5: Jeff owned one passive activity.Jeff sold the

Q12: Interest is not imputed on a gift

Q30: On December 1,2012,Delilah borrows $2,000 from her

Q30: A passive activity includes any rental activity

Q49: Antonio owns land held for investment with

Q61: In 2013,Thomas,who has a marginal tax rate

Q63: Discuss why the distinction between deductions for

Q79: A taxpayer who uses the LIFO method

Q83: On June 11,two years ago,Gia sold land

Q89: Daniel had adjusted gross income of $60,000,which