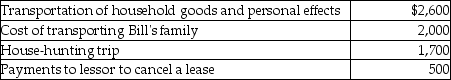

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Definitions:

Readability

The ease with which text can be read and understood by the target audience, often influenced by factors like word choice and sentence structure.

Nursing Interventions

Actions undertaken by nurses to implement healthcare plans and assist patients in achieving their health goals.

Emergency Department

A specialized facility within a hospital that provides immediate treatment to patients with acute illnesses or injuries.

Assailant

An individual who attacks another person physically or verbally, often resulting in harm or distress to the victim.

Q14: Which of the following statements regarding UNICAP

Q16: Matt is a sales representative for a

Q21: Chen had the following capital asset transactions

Q28: Under MACRS,tangible personal property used in trade

Q35: Everest Corp.acquires a machine (seven-year property)on January

Q36: Emily,whose tax rate is 28%,owns an office

Q38: Under the cash method of accounting,payment by

Q50: In 2013,Modern Construction Company entered into a

Q83: On August 1 of this year,Sharon,a cash

Q107: Armanti received a football championship ring in