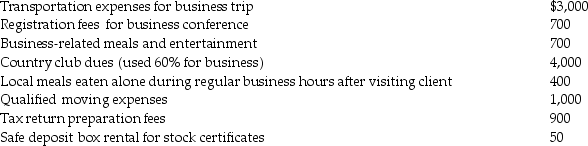

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Distributive Situation

A scenario in negotiation where the involved parties' interests are directly opposed, making the resources seem limited or zero-sum.

Definitions

The precise meanings or explanations of words or concepts.

Dialogue

A conversational exchange through which ideas, thoughts, or information are discussed and shared.

Consensus

General agreement among all members of a group or the process of reaching such agreement.

Q7: Eduardo is planning to purchase some new

Q19: Kevin sold property with an adjusted basis

Q22: If the business usage of listed property

Q33: Arnie is negotiating the sale of land

Q39: Medical expenses paid on behalf of an

Q41: Pete sells equipment for $15,000 to Marcel,his

Q44: Deductible moving expenses include the cost of

Q52: Gayle,a doctor with significant investments in the

Q52: Harrison acquires $65,000 of 5-year property in

Q60: C corporations and partnerships with a corporate