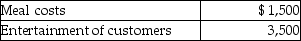

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the different dinners.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the different dinners.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

Elements

Fundamental components or principles that form the basic building blocks of more complex systems or concepts.

Defensive Reaction

A protective response to perceived threats or criticism.

Meeting

A gathering of two or more people convened for the purpose of achieving a common goal through discussion, sharing information, or making decisions.

Work

An activity involving mental or physical effort done in order to achieve a purpose or result, often associated with a profession or occupation.

Q11: May a taxpayer elect under Sec.1033 to

Q30: Residential rental property is defined as property

Q31: Adam owns interests in partnerships A and

Q39: A taxpayer may deduct suspended losses of

Q54: Prior Corp.plans to change its method of

Q59: Jed sells an office building during the

Q61: Jared wants his daughter,Jacqueline,to learn about the

Q74: Blair,whose tax rate is 28%,sells one tract

Q84: A loss on the sale of a

Q110: Darla sold an antique clock in 2013