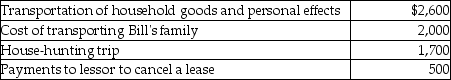

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Definitions:

Totality Quality Management

A management approach centered on quality, based on the participation of all members of an organization and aiming at long-term success through customer satisfaction, and benefits to all members of the organization and to society.

Price Discriminating

A pricing strategy where a company charges different prices for the same product or service to different customers, based on their willingness to pay.

Willingness to Pay

The maximum amount an individual is prepared to spend to purchase a good or service or to avoid something undesirable.

Elastic

Describes a situation where the quantity demanded or supplied responds significantly to changes in price.

Q19: All of the following are true with

Q22: Harry owns equipment ($50,000 basis and $38,000

Q28: Inventory may be valued on the tax

Q33: Section 1250 could convert a portion of

Q38: Candice owns a mutual fund that reinvests

Q72: Daniella exchanges business equipment with a $100,000

Q90: On July 25 of this year,Raj sold

Q93: Realized gain or loss must be recognized

Q100: Sanjay is single and has taxable income

Q117: What are arguments for and against preferential