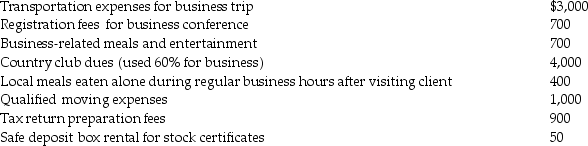

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Stepparents

Individuals who become parents through marriage, partnering with someone who already has children from a previous relationship.

Awareness

The knowledge or perception of a situation or fact, often leading to an informed understanding.

Immersion

The act of engaging deeply or completely in a physical or intellectual activity.

Cumulative Effects Hypothesis

The theory that the impact of multiple stressors or disadvantages accumulates over time, leading to more significant negative effects on an individual's health or well-being than any single factor alone.

Q6: Don's records contain the following information: 1.Donated

Q12: If an NOL is incurred,when would a

Q15: Teri pays the following interest expenses during

Q23: For noncorporate taxpayers,depreciation recapture is not required

Q42: Interest is not imputed on a gift

Q44: Ronna is a professional golfer.In order to

Q51: Joseph has AGI of $170,000 before considering

Q71: Explain how tax planning may allow a

Q90: Explain what types of tax planning are

Q124: On July 1 of the current year,Marcia