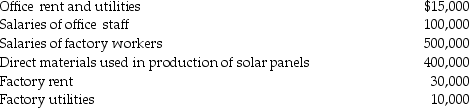

Xerxes Manufacturing,in its first year of operations,produces solar panels which are sold through large building supply and home improvement stores.Xerxes' year-end results include the following:

You are preparing Xerxes' first year tax return.Xerxes has elected a calendar year as its tax accounting period and the accrual method.What additional information would you need to prepare the tax return?

You are preparing Xerxes' first year tax return.Xerxes has elected a calendar year as its tax accounting period and the accrual method.What additional information would you need to prepare the tax return?

Definitions:

Union Shop

A workplace where employees must join the union within a certain timeframe after being hired.

Lockout

An action taken by employers to prevent employees from working during a labor dispute, as a measure to pressure the union into concessions.

Picketing

Job action during a legal strike when employees circulate at the periphery of the job site to persuade others not to do business with the struck employer.

Workers' Compensation Benefits

An insurance type that offers medical benefits and substitutes wages for workers hurt while working.

Q4: With respect to charitable contributions by corporations,all

Q11: What two conditions are necessary for moving

Q28: Individual taxpayers can offset portfolio income with

Q32: Why was Section 1244 enacted by Congress?

Q58: In a parent-subsidiary controlled group,the common parent

Q79: On June 1,2010,Buffalo Corporation purchased and placed

Q89: If a taxpayer has gains on Sec.1231

Q96: With regard to noncorporate taxpayers,all of the

Q99: Marta purchased residential rental property for $600,000

Q104: A corporation has $100,000 of U.S.source taxable