Multiple Choice

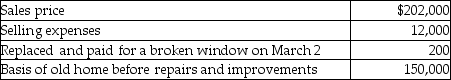

Frank,a single person age 52,sold his home this year.He had lived in the house for 10 years. He signed a contract on March 4 to sell his home and closed the sale on May 3. Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

Definitions:

Related Questions

Q3: A wage cap does not exist for

Q4: If a meeting takes place at a

Q13: On May 18,of last year,Carter sells unlisted

Q36: Summer exchanges an office building used in

Q40: An exchange of inventory for inventory of

Q46: Generally,if inventories are an income-producing factor to

Q59: Travel expenses related to foreign conventions are

Q87: During 2013,Marcia,who is single and is covered

Q88: All of the following are true with

Q93: In 1980,Mr.Lyle purchased a factory building to