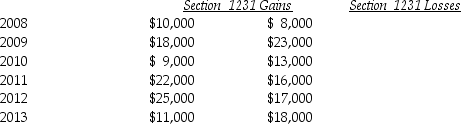

Lucy,a noncorporate taxpayer,experienced the following Section 1231 gains and losses during the years 2008 through 2013.Her first disposition of a Sec.1231 asset occurred in 2008.Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Definitions:

National Average

A statistical measure that represents the central or typical value in a set of data distributed across a nation, used in various contexts like income, test scores, or health indicators.

Suicide Gesture

Motivated by a need for aid and support from others. The intent for a completed suicide is not present, yet the individual wants to draw attention through a “call for help.” Sometimes the gesture turns out to be a completed suicide, yet these are difficult to prove or disprove.

Completed Suicide

The successful act of taking one's own life, resulting in death.

Suicide Rate

The number of suicide deaths in a given population over a specified period, often expressed per 100,000 individuals.

Q12: On April 4,2013,Joan contributes business equipment (she

Q18: All of the following characteristics are true

Q28: Installment sales of depreciable property which result

Q32: In which of the following situations is

Q65: If the recognized losses resulting from involuntary

Q73: Educational expenses incurred by a bookkeeper for

Q74: Blair,whose tax rate is 28%,sells one tract

Q85: One requirement of a personal holding company

Q95: Ron obtained a new job and moved

Q108: Tara transfers land with a $690,000 adjusted