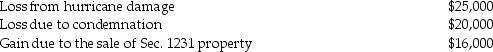

The following gains and losses pertain to Arnold's business assets that qualify as Sec.1231 property.Arnold does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Earliest Part

The initial segment or beginning portion of something, typically referring to time, structures, or processes.

Brain

The organ in the head of humans and other vertebrates that coordinates the body's activities, interpreting sensory information and being the center of thought and emotion.

Evolve

To undergo gradual change or development, typically to a more complex or improved state.

Cerebral Hemisphere

One half of the brain, either the left or right, responsible for different functions; the brain is divided into two such hemispheres.

Q11: Ordinary losses and separately stated deduction and

Q14: What is "forum-shopping"?

Q17: When a taxpayer contacts a tax advisor

Q23: All of the following statements regarding self-employment

Q39: Charades Corporation is a publicly held company

Q71: Jacqueline dies while owning a building with

Q80: Corporations that are members of a parent-subsidiary

Q97: John has $55,000 net earnings from a

Q107: The adoption credit based on qualified adoption

Q127: Ellie,a CPA,incurred the following deductible education expenses