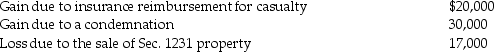

The following are gains and losses recognized in 2013 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

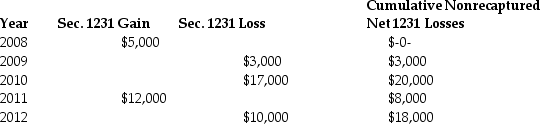

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Corporate Charter

A corporate charter is a legal document issued by a government entity that establishes a corporation's existence and outlines its rights and obligations.

Transferability of Ownership

The capability to legally transfer one's ownership stake in an asset or a company to another party.

Stockholder

An individual or entity that owns shares in a corporation, thus having a claim on its profits and assets.

Transfer

The act of moving money or goods from one place, account, or person to another.

Q1: If certain requirements are met,Sec.351 permits deferral

Q7: Chocolat Inc.is a U.S.chocolate manufacturer.Its domestic production

Q31: Bob and Elizabeth,both 55 years old and

Q40: Which of the following statements regarding proposed

Q60: C corporations and partnerships with a corporate

Q62: Pierce,a single person age 60,sold his home

Q73: In year 1 a contractor agrees to

Q74: Why should tax researchers take note of

Q106: When computing a corporation's alternative minimum taxable

Q114: Martha transferred property with a FMV of