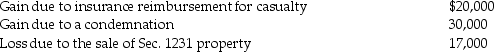

The following are gains and losses recognized in 2013 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

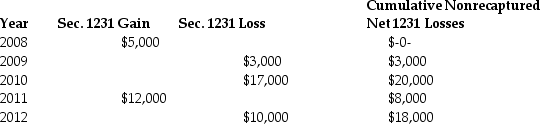

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Community-Based

Refers to programs or services that are developed and operated within a specific community, focusing on the participation and interests of its members.

Primary Prevention

Actions taken to prevent diseases or injuries before they occur.

Teaching Parenting Skills

The process of educating and guiding parents or guardians in effective child-rearing practices, promoting positive communication, discipline, and emotional support.

Medication Nonadherence

The failure to take prescribed medications as directed, which can compromise the effectiveness of treatment.

Q7: An S corporation can have both voting

Q16: Terra Corporation,a calendar-year taxpayer,purchases and places into

Q21: The foreign tax credit is equal to

Q27: The basis of a partnership interest is

Q44: A taxpayer must use the same accounting

Q61: During the course of an audit,a CPA

Q65: Under the MACRS system,the same convention that

Q67: Under the MACRS system,automobiles and computers are

Q82: Identify which of the following statements is

Q123: Corporations may be taxed on less than