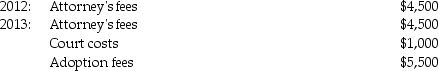

Tyler and Molly,who are married filing jointly with $200,000 of AGI in 2013,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2013.What is the amount of the allowable adoption credit in 2013?

The adoption was finalized in 2013.What is the amount of the allowable adoption credit in 2013?

Definitions:

Origin of Species

The scientific explanation of how different kinds of living organisms are believed to have developed, especially as popularized by Charles Darwin's work.

Homozygous

Refers to having two identical alleles for a particular gene.

Heterozygous

Having two different alleles of a particular gene, one inherited from each parent.

Heterozygous

Having two different alleles for a particular gene, one inherited from each parent.

Q2: Tyne is single and has AGI of

Q7: Sec.1245 can increase the amount of gain

Q14: Limited liability of partners or members is

Q17: Charlie Company is a partnership with two

Q44: A tax bill introduced in the House

Q64: Which of the following assets is 1231

Q70: Under the Pension Model,the entire accumulation,not just

Q92: When a court discusses issues not raised

Q96: Individuals are the principal taxpaying entities in

Q110: If a partner contributes depreciable property to