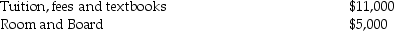

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2013:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Production Possibilities Curve

A graphical representation illustrating the maximum quantity of two goods that can be produced within a given period under the conditions of a fixed amount of resources and technology.

Infrastructure

The fundamental facilities and systems serving a country, city, or area, including transportation and communication systems, power plants, and schools.

Unemployment Rate

The proportion of the working sector that lacks employment but is in the hunt for jobs.

Technology

The application of scientific knowledge for practical purposes, especially in industry and the development of innovations.

Q39: On May 1 of this year,Ingrid sold

Q41: The Roth IRA is an example of

Q49: On May 1,2008,Empire Properties Corp.,a calendar year

Q56: Sarah owned land with a FMV of

Q57: The Deferred Model offers two levels of

Q72: Discuss the options available regarding treatment of

Q78: Nolan earns a salary of $80,000 and

Q80: Kerry is single and has AGI of

Q93: Marvin and Pamela are married,file a joint

Q96: With regard to noncorporate taxpayers,all of the