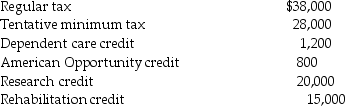

Ivan has generated the following taxes and credits this year:

How much general business credit will he apply to the current year tax liability?

How much general business credit will he apply to the current year tax liability?

Definitions:

Sales Tax

A tax imposed by a government on the sale of goods and services, typically calculated as a percentage of the purchase price.

General Journal Entries

Recorded business transactions in the general journal, forming the foundation of a company's financial records.

Terms of Sale

Conditions agreed upon by the buyer and seller regarding the delivery, payment, and transfer of ownership of goods.

Credit Terms

The conditions under which credit will be extended to a borrower, including repayment schedule, interest rate, and the duration of the loan.

Q6: Emma owns a small building ($120,000 basis

Q13: Final regulations can take effect on any

Q14: Miles invests $20,000 in a taxable bond

Q38: In all situations,tax considerations are of primary

Q40: Stephanie owns a 25% interest in a

Q45: Common examples of the Pension Model include

Q48: Dividends paid from E&P are taxable to

Q56: Your client wants to deduct commuting expenses

Q69: When given a choice between making a

Q80: Under the accrual method of accounting,the two