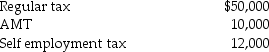

Beth and Jay project the following taxes for the current year:

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

a.AGI of $140,000 and total taxes of $36,000.

b.AGI of $155,000 and total taxes of $50,000.

Definitions:

Experimental Groups

In research, these are groups where the subjects are exposed to the treatment or condition being tested to measure its effect.

Control Groups

In experimental research, a group of subjects that does not receive the treatment or intervention being tested, serving as a benchmark to measure the effect of the treatment.

Bender Visual-Motor Gestalt Test

A psychological assessment that evaluates visual-motor functioning, perceptual skills, and neurological impairments by analyzing an individual's execution of specific drawings.

Neuropsychological Test

A standardized assessment tool used to measure a specific aspect of brain function and cognitive performance.

Q1: S Corporations result in a single level

Q3: Lars has a basis in his partnership

Q6: Emma owns a small building ($120,000 basis

Q22: Harry owns equipment ($50,000 basis and $38,000

Q37: A flow-through entity's primary characteristic is that

Q54: Prior Corp.plans to change its method of

Q63: Lance transferred land having a $180,000 FMV

Q69: Except in a few specific circumstances,once adopted,an

Q75: For livestock to be considered Section 1231

Q113: Felicia contributes property with a FMV of