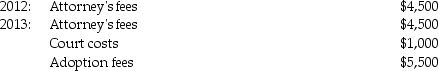

Tyler and Molly,who are married filing jointly with $200,000 of AGI in 2013,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2013.What is the amount of the allowable adoption credit in 2013?

The adoption was finalized in 2013.What is the amount of the allowable adoption credit in 2013?

Definitions:

Broad Reasoning

The ability to think in wide, abstract terms about diverse concepts, often involving forming connections between seemingly unrelated ideas.

Social Intelligence

The ability to understand and manage interpersonal relationships, comprehend social environments, and navigate social situations effectively.

Emotional Intelligence

The ability to recognize, understand, manage, and reason with emotions in oneself and others.

Traditional IQ Tests

Conventional assessments designed to measure intelligence through a standardized series of tasks or questions, evaluating a range of cognitive abilities.

Q14: On April 12,2012,Suzanne bought a computer for

Q14: What is "forum-shopping"?

Q19: A self-employed individual has earnings from his

Q24: Nonrefundable credits may offset tax liability but

Q33: Section 1250 could convert a portion of

Q36: An LLC that elects to be taxed

Q41: Statements on Standards for Tax Services are

Q51: Property transferred to the decedent's spouse is

Q86: If the taxpayer elects to defer the

Q117: All of the following are separately stated