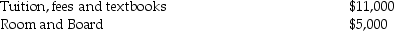

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2013:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Nonfiction Books

Literary works based on facts, real events, and real people, such as biographies, histories, and essays.

Horizontal Social Mobility

describes the movement of individuals or groups across similar social positions without a change in their social status.

Auto Plants

Factories where automobiles are manufactured, involving assembly lines and complex machinery to produce vehicles.

American Dream

The ethos of the United States, representing the set of ideals (democracy, rights, liberty, opportunity, and equality) in which freedom includes the opportunity for prosperity and success.

Q2: Identify which of the following statement is

Q7: Discuss why a taxpayer would want to

Q8: Generally,economic performance must occur before an expense

Q43: James and Ellen Connors,who are both 50

Q50: Because a partnership is a pass-through entity

Q65: The general form of the annualized after-tax

Q76: Identify which of the following statements is

Q79: A single taxpayer earns a salary of

Q98: If a corporation owns less than 20%

Q105: Ivan has generated the following taxes and