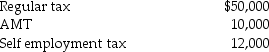

Beth and Jay project the following taxes for the current year:

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

a.AGI of $140,000 and total taxes of $36,000.

b.AGI of $155,000 and total taxes of $50,000.

Definitions:

Net Income

The remaining earnings of a business after deducting all costs and taxes from its total income.

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated by adding purchases to beginning inventory and subtracting the cost of goods sold.

Net Income

The final profit figure for a company, arrived at by removing all expenses and tax payments from its revenue.

Increasing Costs

A situation where production or operating expenses grow over time, often due to inflation, increased demand for resources, or higher labor costs.

Q6: Blue Corporation distributes land and building having

Q22: If the business usage of listed property

Q24: Stephanie's building,which was used in her business,was

Q29: A newly married person may change tax

Q34: For purposes of the accumulated earnings tax,reasonable

Q47: Stephanie owns a 25% interest in a

Q62: Andrew sold land to Becca,Andrew's daughter.The fair

Q73: All costs of organizing a partnership can

Q86: Terry has sold equipment used in her

Q87: Discuss the purposes and scope of temporary