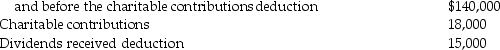

Hazel Corporation reported the following results for the current year:

Taxable income before the dividends-received deduction

What is the amount of the taxable income for the current year and what is the amount of the charitable contributions carryover to next year?

What is the amount of the taxable income for the current year and what is the amount of the charitable contributions carryover to next year?

Definitions:

Contribution Format

A statement or report format, primarily used in managerial accounting, that separates fixed and variable costs to evaluate the performance of a profit center.

Variable Expenses

Costs that change in proportion to the level of activity or production volume.

Break-Even Sales

The amount of revenue needed to cover all fixed and variable costs, resulting in a net income of zero.

Retail Division

A segment of a company that directly sells products to consumers, typically involving activities and costs related to retail operations.

Q18: Under what circumstances might a tax advisor

Q20: Major Corporation's taxable income for the current

Q21: John transfers assets with a $200,000 FMV

Q45: What is the difference between a taxpayer-requested

Q59: Given a choice between a fully-taxable investment

Q97: A liquidating distribution is treated as a

Q99: In a Sec.351 transfer,the corporation takes the

Q100: In the syndication of a partnership,brokerage and

Q128: Unused charitable contributions of a corporation are

Q133: Charishma is a taxpayer with taxable income