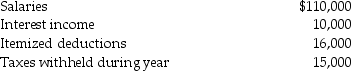

Brad and Angie had the following income and deductions during 2014:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Definitions:

Privileges and Immunities Clause

A provision in the U.S. Constitution that prevents a state from treating citizens of other states in a discriminatory manner.

Collect Taxes

The process by which a governmental authority requires individuals or entities to contribute to public revenues.

Judicial Review

The power of a court to review legislative and executive actions, such as a law or an official act of a government employee or agent, to determine whether they are constitutional.

Marbury v. Madison

A seminal U.S. Supreme Court case in 1803 that established the principle of judicial review, empowering courts to strike down laws and executive actions they find unconstitutional.

Q5: Bob transfers assets with a $100,000 FMV

Q11: In an S corporation,shareholders<br>A)are taxed on their

Q15: Becky wins a car and furniture on

Q23: Ben,age 67,and Karla,age 58,have two children who

Q42: Sarah contributes $25,000 to a church.Sarah's marginal

Q55: In addition to Social Security benefits of

Q57: S corporations are flow-through entities in which

Q59: Cheryl is claimed as a dependent on

Q61: On April 2 of the current year,Jana

Q92: During the current tax year,Frank Corporation generated