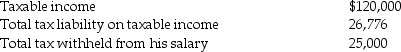

Frederick failed to file his 2014 tax return on a timely basis.In fact,he filed his 2014 income tax return on October 31,2015,(the due date was April 15,2015)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2014 return:

Frederick sent a check for $1,776 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2014.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,776 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2014.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Intangible Nature

Refers to the non-physical qualities or characteristics of services and goods, like brand image or customer experience.

Quality

The degree of excellence of a product or service, often measured against other similar products or services.

Price of a Service

The amount of money charged for the performance of a specific task or service provided to consumers or businesses.

Tuition

The fee charged for instruction or teaching, typically in a formal educational institution.

Q3: Lars has a basis in his partnership

Q15: Jan can invest $4,000 of after-tax dollars

Q32: Alexis and Terry have been married five

Q35: Joey and Bob each have 50% interest

Q38: Limited liability companies may elect to be

Q71: The recipient of a taxable stock dividend

Q82: Ariel receives from her partnership a nonliquidating

Q94: Oliver receives a nonliquidating distribution of land

Q105: The check-the-box regulations permit an LLC to

Q123: Corporations may be taxed on less than