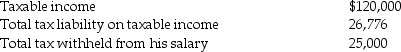

Frederick failed to file his 2014 tax return on a timely basis.In fact,he filed his 2014 income tax return on October 31,2015,(the due date was April 15,2015)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2014 return:

Frederick sent a check for $1,776 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2014.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,776 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2014.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Fecal Impaction

A severe form of constipation where hard stool masses are stuck in the rectum and cannot be expelled.

Rectal Abscess

A collection of pus in the tissue surrounding the rectum, often causing pain and swelling.

Distended Abdomen

An increase in abdominal size, often due to gas, fluid accumulation, or enlargement of abdominal organs.

Thrombosed Hemorrhoid

A hemorrhoid in which a blood clot has formed, often causing severe pain and swelling.

Q8: Regulations issued prior to the latest tax

Q12: Flow-through entities do not have to file

Q27: Matt and Sheila form Krupp Corporation.Matt contributes

Q29: Gross income may be realized when a

Q37: A citator enables tax researchers to locate

Q46: Atiqa receives a nonliquidating distribution of land

Q59: The Senate equivalent of the House Ways

Q68: Ralph transfers property with an adjusted basis

Q78: In order to shift the taxation of

Q81: Distinguish between an annotated tax service and