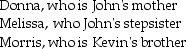

John supports Kevin,his cousin,who lived with him throughout 2014.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $3,950. How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $3,950. How many personal and dependency exemptions may John claim?

Definitions:

Saturation

The point at which a substance cannot absorb or dissolve any more of another substance, or in media, the state of being completely filled with content.

Physical Characteristics

The defining traits or features of a person's body, including height, weight, skin color, hair type, and facial features.

Intensity

The magnitude or strength of a phenomenon or a signal, often used in contexts ranging from physics to emotions.

Wavelength

The distance between successive crests of a wave, especially points in a sound wave or electromagnetic wave.

Q18: When a change in the tax law

Q38: Hannah is single with no dependents and

Q43: In the Deferred Model,only after-tax dollars are

Q74: You need to locate a recent tax

Q89: A tax case cannot be appealed when

Q90: Which of the following types of evidence

Q96: Title 26 of the U.S.Code includes<br>A)income tax

Q97: All of the taxable income of a

Q113: Distinguish between an annotated tax service and

Q121: Norah,who gives music lessons,is a calendar year