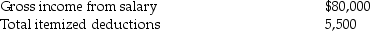

Steve Greene,age 66,is divorced with no dependents. In 2014 Steve had income and expenses as follows:

Compute Steve's taxable income for 2014.Show all calculations.

Compute Steve's taxable income for 2014.Show all calculations.

Definitions:

Reciprocity

A social principle where positive actions lead to similar responses by others, fostering mutual benefit or exchange.

Consensus

General agreement among the members of a group or community.

Framing

The process of presenting or structuring information and issues in a particular way to influence interpretation or decision making.

Credibility

The quality or attribute of being believable or worthy of trust based on one's reliability, expertise, and honesty.

Q14: Explain the difference between a closed-fact and

Q15: What are the purposes of citations in

Q28: What are the characteristics of the Pension

Q36: Dividends paid from most U.S.corporations are taxed

Q38: Nikki exchanges property having a $20,000 adjusted

Q69: When given a choice between making a

Q80: The AAA Partnership makes an election to

Q82: Amounts collected under accident and health insurance

Q94: Oliver receives a nonliquidating distribution of land

Q109: Blaine Greer lives alone.His support comes from