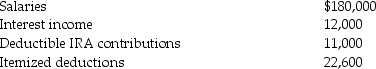

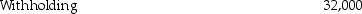

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2014. Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

Definitions:

Allowance Method

An accounting technique used to account for bad debts, which estimates and sets aside a portion of accounts receivable deemed unlikely to be collected.

Uncollectible Receivables

Debts owed to a company that are considered to be uncollectable, indicating that the company does not expect to receive payment due to the debtor's inability to pay.

Percentage of Sales

A financial ratio that compares a particular expense or cost to the total sales revenue, often used to analyze cost behavior or performance.

Note Duration

The total length of time until a note payable or receivable matures and is to be repaid or collected.

Q13: Identify which of the following statements is

Q21: Norman transfers machinery that has a $45,000

Q40: Francine Corporation reports the following income and

Q61: A taxpayer's average tax rate is the

Q65: In a limited liability partnership,a partner is

Q67: What is the difference between a taxpayer-requested

Q83: Denzel earns $130,000 in 2014 through his

Q85: Refundable tax credits are allowed to reduce

Q109: Which of the following statements regarding the

Q132: In October 2013,Joy and Paul separated and