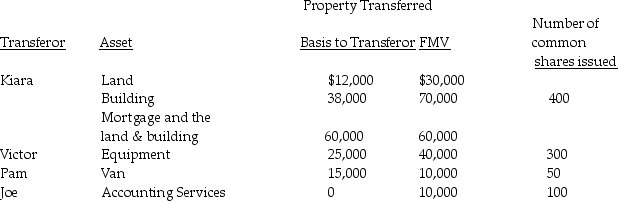

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Sociological Theories

Frameworks for understanding society and human behavior that guide sociologists' interpretations and research.

Global Inequality

The systematic differences in health, wealth, and power across countries and societies worldwide.

Social Inequality

Refers to the unfair distribution of resources, opportunities, and rights among different social statuses or groups within a society.

Social Relations

encompasses the interactions and relationships among individuals within a society, influenced by various socio-economic and cultural factors.

Q7: A medical doctor incorporates her medical practice,which

Q29: Corporations are permitted to deduct $3,000 in

Q36: A C corporation must use a calendar

Q36: An individual who is claimed as a

Q37: Identify which of the following statements is

Q51: The tax statutes with the popular name

Q56: Kiara owns 100% of the shares of

Q71: Which of the following dependent relatives does

Q84: On April 1,Delta Corporation distributes $120,000 in

Q96: Lori had the following income and losses