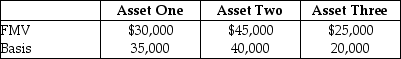

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec.351.  Max's recognized gain is

Max's recognized gain is

Definitions:

Uniform Acts

Model statutes drafted by legal experts to promote uniformity and consistency in state laws on certain subjects across the United States.

Treaty

A formally negotiated and ratified agreement between or among countries.

Convention

A formal agreement between states, often a treaty, or a large meeting or conference, especially of members of a profession or a political party.

Treaty Conflicts

Situations where provisions or obligations in an international treaty conflict with either another treaty or a country's domestic laws.

Q18: A taxpayer can receive innocent spouse relief

Q37: Which of the following steps,related to a

Q43: Larry and Ally are married and file

Q62: Green Corporation is incorporated on March 1

Q65: If a taxpayer's method of accounting does

Q79: Final regulations have almost the same legislative

Q89: A taxpayer may avoid tax on income

Q99: Identify which of the following statements is

Q101: The cash receipts and disbursements method of

Q101: Sally divorced her husband three years ago