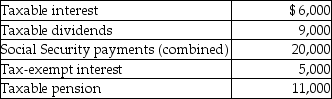

Mr.& Mrs.Bronson are both over 65 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

Definitions:

Stages

Distinct phases or periods in a process of development or series of events, often marked by specific features or milestones.

Early Adulthood

A life stage typically occurring from the late teens through the twenties, marked by personal and professional development, and the pursuit of independence.

Physical Development

The biological process of growth and change in the body's structures, including motor and muscular development, throughout the life span.

Motives

Psychologically based forces that underlie an individual's willingness to act or behave in a particular way, driven by needs, desires, or goals.

Q5: Candice owns a mutual fund that reinvests

Q10: In 2006,Gita contributed property with a basis

Q34: In 2011 Toni purchased 100 shares of

Q37: Discuss the impact of the contribution of

Q53: In a community property state,jointly owned property

Q72: When a taxpayer contacts a tax advisor

Q78: Davis Corporation,a manufacturer,has taxable income of $150,000.Davis's

Q100: Tyler has rented a house from Camarah

Q105: Chad and Jaqueline are married and have

Q137: Discuss reasons why a married couple may