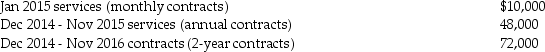

The Cable TV Company,an accrual basis taxpayer,allows its customers to pay by the month,by the year,or two years in advance.In December 2014,the company collected the following amounts applicable to future services:

Assuming Cable TV wants to minimize income reported for 2014,what is the amount of gross income that must be reported for 2014 and how much of the income from these contracts will be reported in 2015?

Assuming Cable TV wants to minimize income reported for 2014,what is the amount of gross income that must be reported for 2014 and how much of the income from these contracts will be reported in 2015?

Definitions:

Q3: Tax planning is not an integral part

Q18: A new corporation may generally select one

Q28: West Corporation purchases 50 shares (less than

Q34: Ellen,a CPA,prepares a tax return for Frank,a

Q66: Nichol Corporation has 100 shares of common

Q79: The assignment of income doctrine does not

Q79: David,age 62,retires and receives $1,000 per month

Q90: Nonrefundable tax credits are allowed to reduce

Q105: Joel has four transactions involving the sale

Q112: For federal income tax purposes,income is allocated